- In 2025 U.S. equities delivered another strong year, with the S&P 500 rising +16.4%, its third straight year of gains above 15%. Solid consumer spending, a resilient economy, and rapid advances in artificial intelligence fueled the rally, particularly in the technology sector.

- Yet even in a market driven by optimism and expanding valuations, the Everest Formula outperformed once again. From January 1 to December 31, the Everest Strategy posted an average return of +22.5%, demonstrating its ability to uncover high-quality, undervalued opportunities when market euphoria is at its peak.

- This article breaks down the 2025 results in detail, analyzing the two most widely followed Everest approaches: the 3-stock and 10-stock strategies, and highlighting the standout stocks the Formula identified during this exceptional year.

2025 consolidated performance

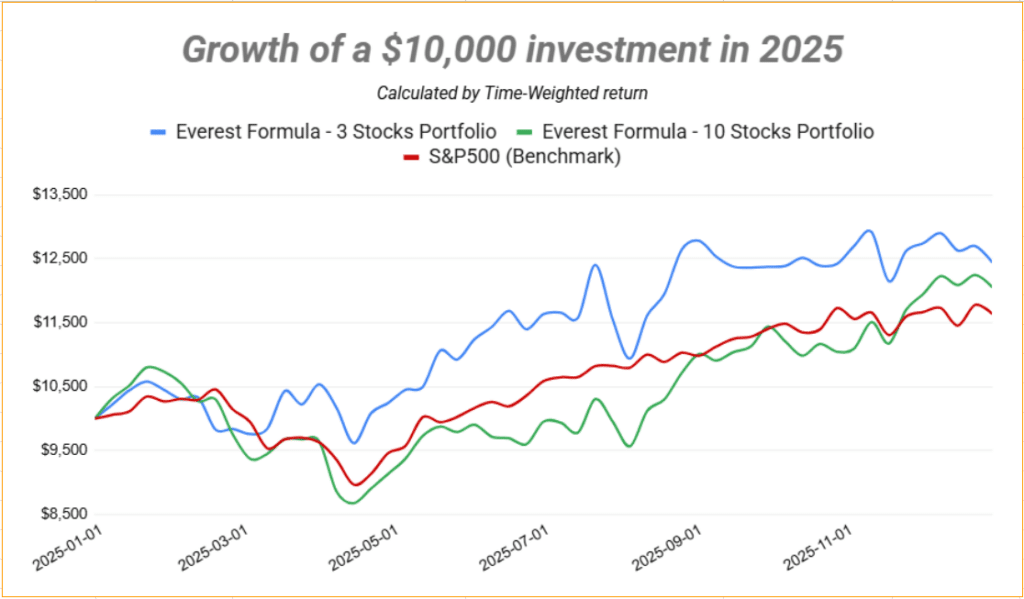

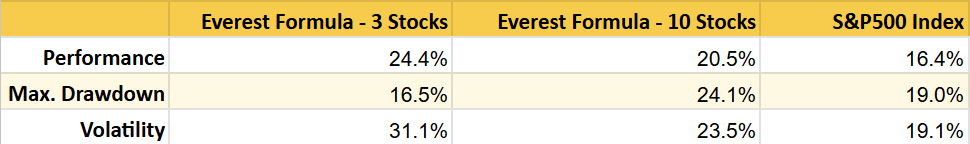

In the whole year of 2025, the Everest Formula 3-stock strategy had a performance of +24.4%, turning a hypothetical portfolio of $10,000 invested on January 1, 2025, into $12,440 on January 1, 2026. The 10-stock Everest Formula strategy follows closely, registering a gain of +20.5% and turning the same amount into $12,054. In the same period, the S&P500 index registered a performance of +16.4%, a solid performance, but which, even for this year, lags behind the results of the Everest Formula.

Despite the strong and consistent performance of the Everest Formula, it’s important to recognize that it comes with higher volatility and deeper drawdowns than broad market indexes such as the S&P 500. As emphasized repeatedly, strategies built on a limited number of stocks inevitably experience sharper price swings, which may be uncomfortable for more risk-averse investors. For this reason, we recommend allocating the Everest Formula only to the higher-risk portion of your portfolio, which is specifically designed to pursue superior long-term returns.

The Everest Formula continues year after year to confirm the exceptional value that it brings to investors who decided to get the opportunity to apply the strategy. Over the last 24 years, Everest Formula’s strategies had an average compound annual growth rate of 29.3%, and last year the performance was in line with it.

Everest Top Picks

Most of the stocks that the Everest Formula chose in 2025 have had a significant increase in their price, but some of them performed exceptionally well. We are going to review those and evaluate whether they are still a bargain to buy now.

DDS – Dillard’s Inc.

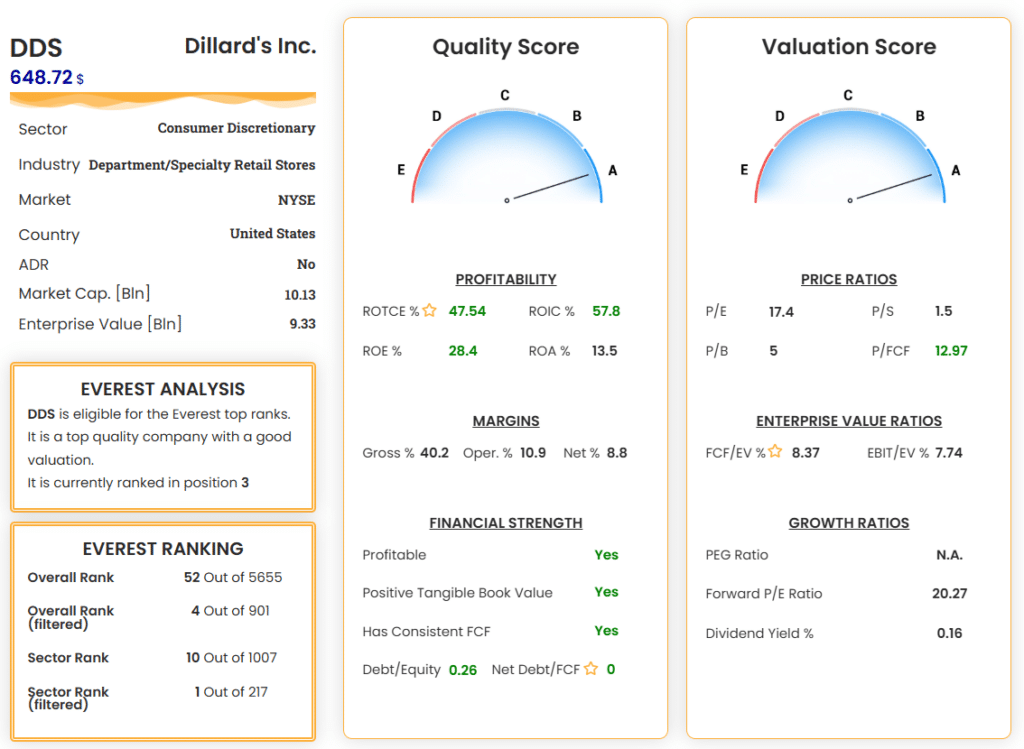

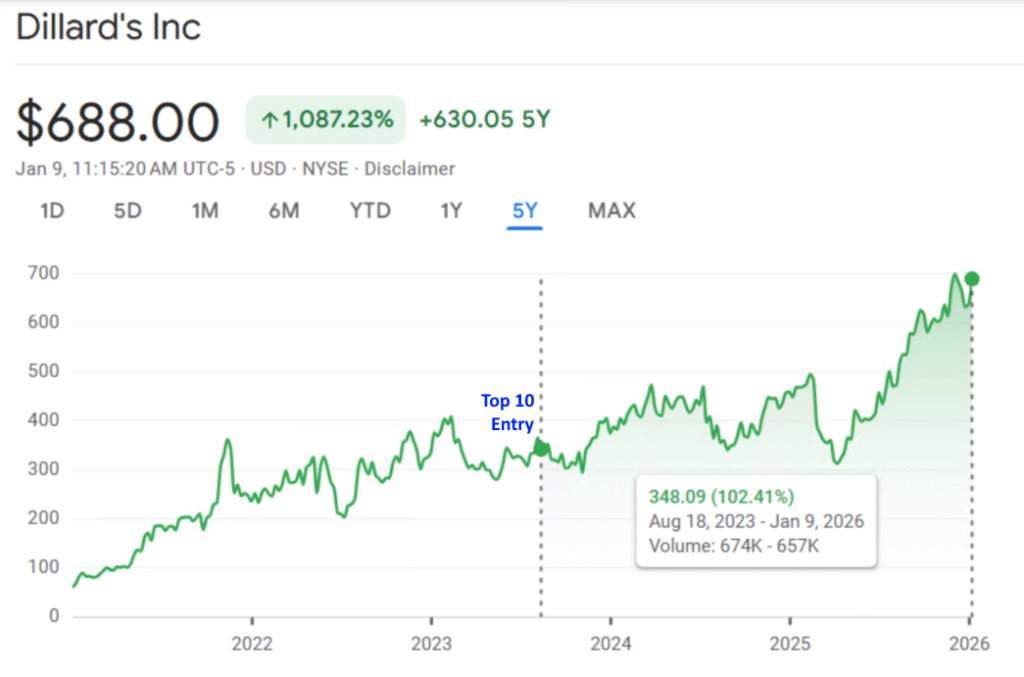

Dillard’s, Inc. is an American department-store chain with a long retail history and over 270 locations across the United States, known for fashion, accessories, home goods, and a strong balance sheet. The company entered the Everest Top 10 rank in August 2023 because market sentiment was weak, fundamentals were stable, and valuation metrics lagged peers despite solid cash flow and buybacks. Since then, the stock has climbed significantly, rising well into 2025 and delivering strong returns as investors re-rated the business and performance improved, supported by sales growth and special dividends.

DDS’s current outlook: DDS is still a good buy, being still in the top 10, at position 4. Although the price has increased recently, the valuation metrics are still very good, with a P/E of 17, a stable and consistent free cash flow, and an amazing balance sheet. The management is strong and has kept a strong ROIC over 50% since COVID-19.

BIIB – Biogen Inc.

Biogen Inc. is a major U.S. biotechnology company focused on developing treatments for neurological and neurodegenerative diseases, including multiple sclerosis, spinal muscular atrophy, and Alzheimer’s disease.

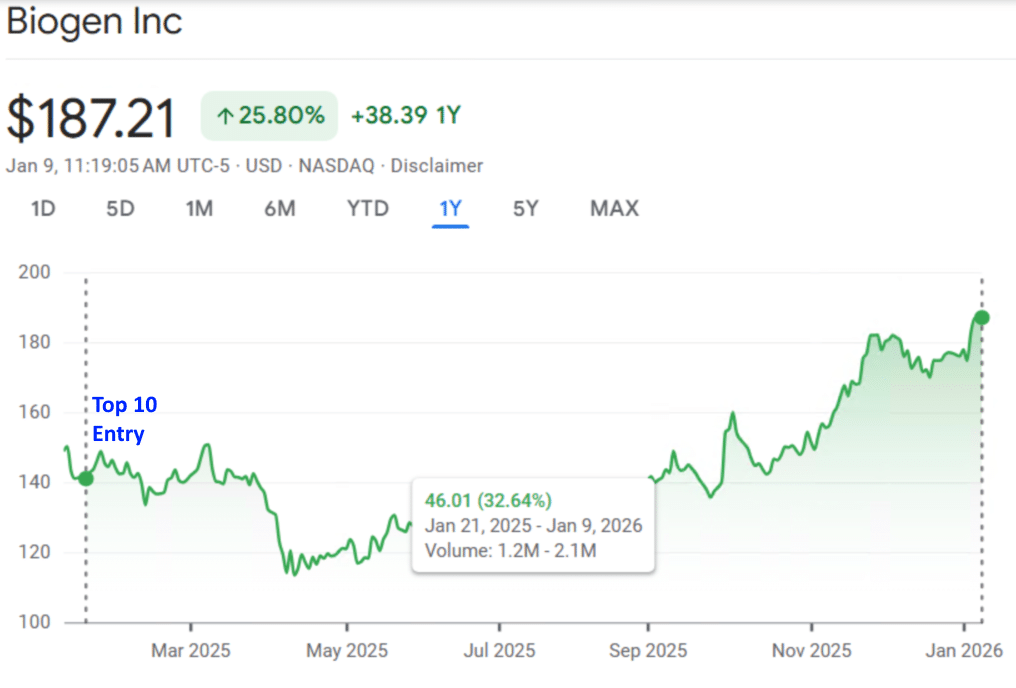

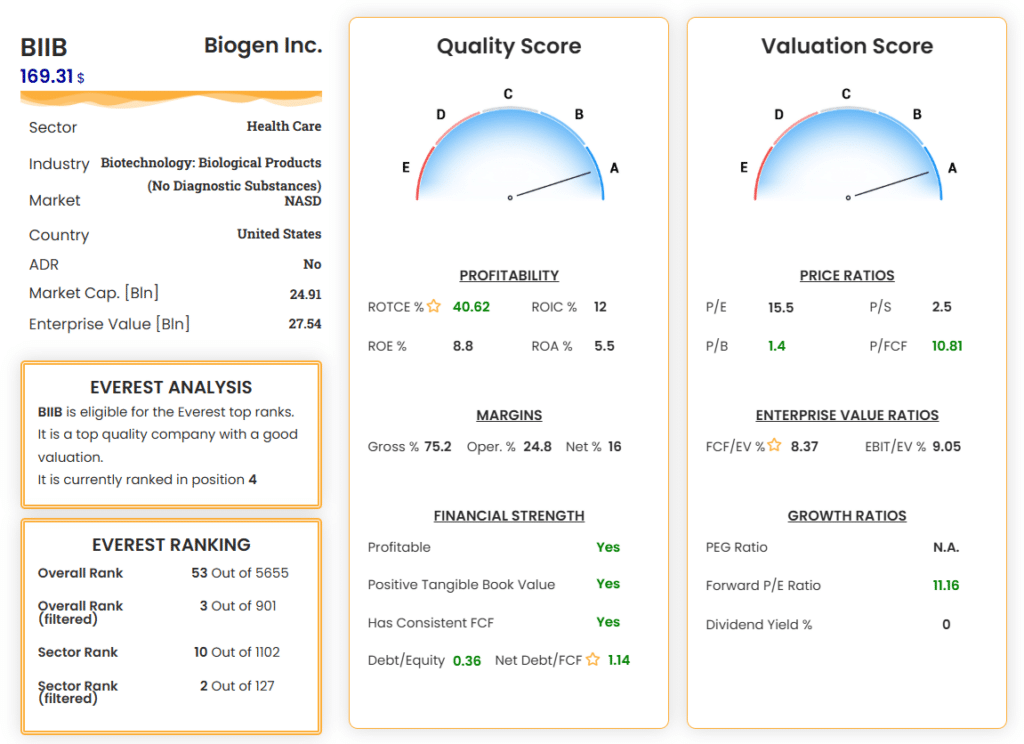

In February 2025, the Everest Formula flagged Biogen as undervalued because its share price was languishing near multi-year lows amid disappointing guidance and concerns over slowing sales in key drug franchises, even though valuation metrics like P/E and free cash flow looked attractive relative to fundamentals and peers. Since then, the stock has shown signs of recovery with improved technical momentum and renewed analyst interest in its pipeline and valuation. The stock is up more than 30% and is still growing.

BIIB’s current outlook: Biogen is still inside the 3-stock strategy of the Everest Formula, at position 3. Despite the recent surge, the P/E remains at multi-year lows (15.5), which is impressive if combined with a high ROTCE and a really low debt. Biogen is still one of the best bargains in the market right now.

The Bottom Line

During 2025 the Everest Formula identified exceptional companies, delivering results in line with its long-term annual average of 30% achieved over the past 24 years. While no one can guarantee that these returns will be repeated every year, our conviction remains unchanged: investing in high-quality businesses when they are undervalued is a strategy that stands the test of time.